Background

IFRS 9 introduces new requirements that affect entities across all industry sectors. Although it is true that the most significant effects are faced by entities in the financial sector, it is proven to be a common mistake to assume that there are limited effects elsewhere.

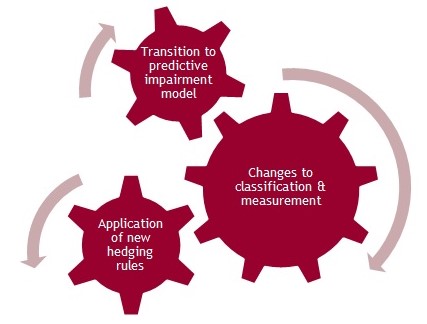

Steps to implementation

The adoption of IFRS 9 should be considered in three distinct phases:

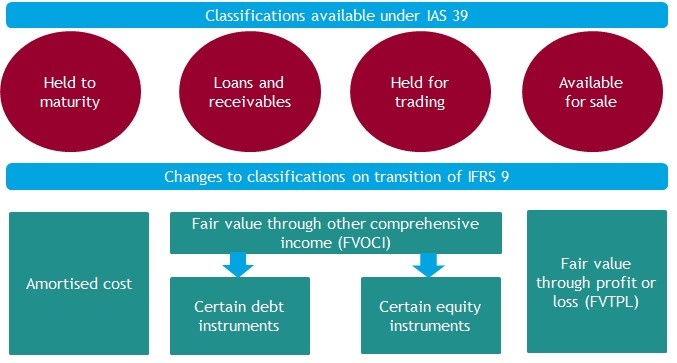

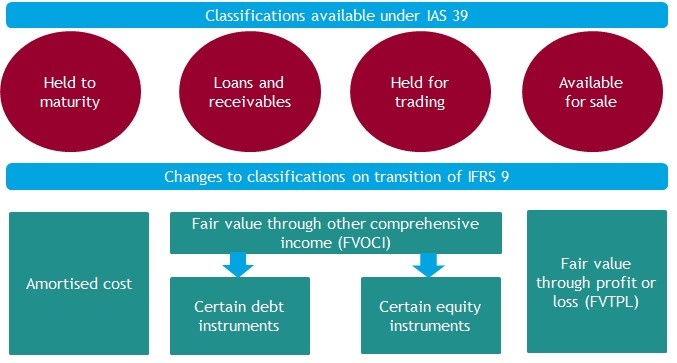

Classification & Measurement

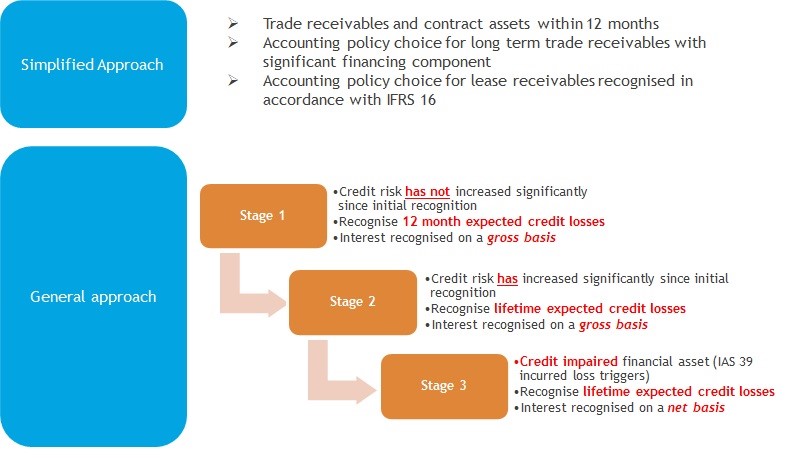

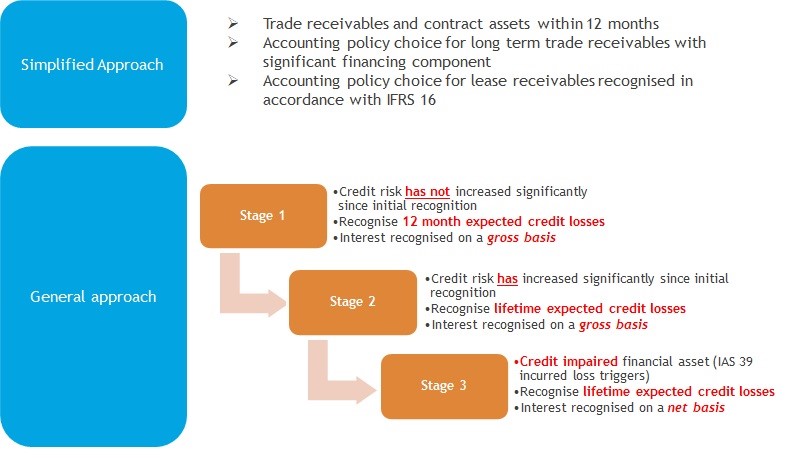

Impairment

Questions which should be asked for adoption include:

Project management, Board sponsorship and communication with those charged with governance:

- What is the plan for transition?

- Which transitional approach and options are being adopted and why?

- Who is responsible?

- What resources are available?

- What sponsorship does the project have at executive board level?

- How has the audit committee been briefed?

Detailed effects:

- What are the likely effects on the classification and measurement of financial assets and liabilities?

- What sources of information have been identified in order that expected credit losses can be calculated?

- What are the likely effects arising from the changes to the hedge accounting requirements?

- How will changes in amounts recognised in the financial statements affect bonus payments, share option plans, banking covenants and costs, and dividend policy?

- How will brokers and analysts react?

- What changes to systems and processes will be required (including the identification of a significant increase in credit risk for the purposes of the impairment test)?

- What are the staff training requirements (including sales and marketing staff, as well as finance staff)?

- How will marketing, credit and finance departments need to liaise and communicate with each other in future?

What we can offer:

-

Performing a detailed impact assessment of the adoption of IFRS 9.

-

Providing assistance with the quantification of adjustments at the date of initial application and reporting date relating to both classification and measurement (C&M) and expected credit losses (ECL).

-

Providing assistance in complying with the new hedge requirements and performing hedge effectiveness testing.

For more details and guidance on IFRS 9 application, please see IFRS Publications by BDO.