With the on-set of the Corporate Tax (CT) regime in the UAE, each licensee will need to obtain a CT registration and file an annual CT return. A registration option for corporate groups will be to form a CT Group. This allows the group to be covered by a single CT registration and file a single CT return. This is a similar concept to VAT grouping but the conditions for forming a VAT Group are more relaxed than that of a CT Group.

The key conditions for forming a CT Group are listed below:

- Only resident persons can form part of CT Group. Permanent Establishments (PE) or branches of foreign companies in the UAE cannot join a CT Group;

- Only juridical resident persons can join a CT Group. Natural persons and unincorporated JVs are ineligible.

- CT grouping is available only to parent-subsidiary relationships, where all of the following conditions are met:

1. Parent owns at least 95% shareholding of the subsidiary;

2. Parent owns at least 95% voting rights of the subsidiary; and

3. Parent is entitled to at least 95% of the subsidiary’s profits and net assets. - Neither the parent nor the subsidiary is exempt from CT;

- Neither the parent nor the subsidiary is a Qualifying Free Zone Person;

- The parent and the subsidiaries must have the same financial year and prepare financial statements using the same accounting standards.

BDO insight

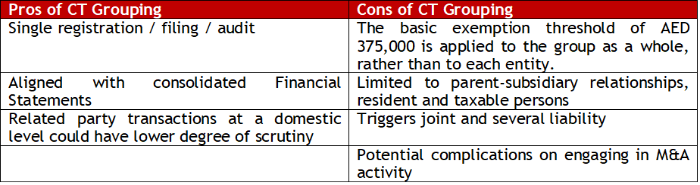

While forming a CT Group appears to be an efficient compliance option it is important evaluate whether firstly, the CT Grouping conditions are met and secondly, whether CT Grouping makes sense. Following, are a few of the important pros and cons associated with forming a CT Group.

Based on these pros and cons, businesses need to evaluate the cost of compliance obligations v. exposure in other areas to arrive at a calculated decision on whether to form a CT Group.

In addition to CT grouping provisions, there are also reliefs for ‘Qualifying Groups’, where the conditions are relaxed compared to those for a CT Group. Qualifying Groups are permitted to transfer assets and liabilities between their members at net book value. The main condition for a Qualifying Group is that one of the group members owns 75% or more of the other, or a third party owns 75% or more of both entities. Members of a Qualifying Group are required to obtain separate CT registration and file separate CT returns.

Subscribe to receive the latest BDO News and Insights

Please fill out the following form to access the download.