On 28 April 2021, the UAE Cabinet of Ministers issued Decision No. 49/2021, amending provisions of Cabinet Decision No. 40/2017 regulating tax penalties. The new resolution is applicable effective sixty(60) days as of the date of its issuance. We summarise below some of the most significant changes

Partial amnesty on tax penalties

The Cabinet Decision outlines an amnesty that will allow unpaid penalties, which were levied under the old rules, to be reduced by 70 %, provided the taxpayer settles the unpaid tax and penalties by 31 December 2021. The Federal Tax Authority (FTA) will be responsible for determining the procedures for implementing the amnesty, and these will be published in due course.

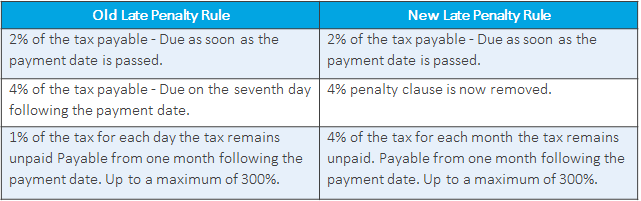

Reduction in late payment penalties

The Cabinet Decision includes a reduction in the late payment penalty that taxpayers will welcome. Below is the summary of the old and new late payment penalties:

Late registration and deregistration penalties

Failure to submit an application for registration within the prescribed time limits: Reduced from AED 20,000 to AED 10,000

Failure to submit an application for deregistration within the prescribed time limits: Reduced from AED 10,000 to AED 1,000

Failure to keep records

Failure to keep records specified in the tax law: First violation AED 10,000 (no change), repeated violations: reduced from AED 50,000 to AED 20,000

Change in circumstances

Failure to inform the FTA of any change requiring amendment of Authority’s records: First violation AED 5,000 (no change), repeated violations: reduced from AED 15,000 to AED 10,000

Legal Representatives

Failure by a legal representative for the taxable person to inform the FTA of the appointment within the specified timeframe: Reduced from AED 20,000 to AED 10,000 (payable by the Legal Representative).

Tax inclusive prices

Failure to display tax inclusive prices: Reduced from AED 15,000 to AED 5,000.

Excise goods

Failure to provide the Authority with price lists: First time AED 5,000 (no change), repetitions: reduced from AED 20,000 to AED 10,000

Invoices and credit notes

Failure to issue tax invoices or tax credit notes or failure to comply with the conditions for the issue of electronic tax invoices or credit notes: reduced from AED 5,000 per document to AED 2,500 for each discovered case.

Full guidance on these changes and the publication of the decision in Arabic and English is expected in due course.

If you require any further information on this matter, please contact any of our Tax specialists.

Subscribe to receive the latest BDO News and Insights

KEY CONTACTS

SHIVENDRA JHA

Head of Advisory and International Liaison Partner (ILP)

ASHISH ATHAVALE

Partner - Tax Advisory Services

Please fill out the following form to access the download.